Corporate Governance

Corporate Governance Essentials

- No Hidden Charges

- Lowest Price Guarantee

- Quick and Hassle - Free Process

- Free Expert Assistance.

Enquiry

Navigating Corporate Governance: Principles, Practices, and Strategies for Effective Business Management

Our Corporate Governance page provides insights into the principles, practices, and strategies that underpin effective corporate governance. Explore the importance of transparency, accountability, and integrity in business management, and learn how robust corporate governance can drive organizational success and sustainability.

Corporate Governance

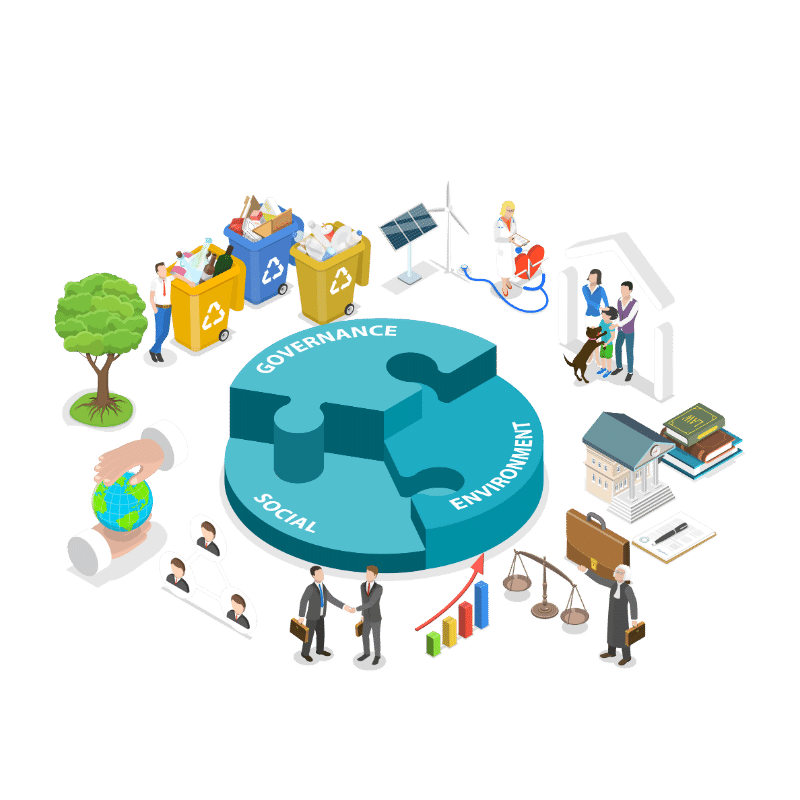

What is Corporate Governance?

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government, and the community. The aim of corporate governance is to ensure that the company’s management acts in the best interests of the shareholders while also taking into account the interests of other stakeholders. Good corporate governance is essential for creating a business environment that promotes integrity, transparency, and accountability, which are crucial for long-term success and sustainability.

Benefits of Corporate Governance

Enhanced Transparency: Corporate governance practices promote transparency by ensuring that relevant information is disclosed to stakeholders in a timely and accurate manner.

Improved Accountability: By establishing clear roles and responsibilities for the board of directors, management, and other stakeholders, corporate governance helps ensure accountability for decisions and actions.

Effective Risk Management: Corporate governance frameworks include mechanisms for identifying, assessing, and managing risks, helping organizations mitigate potential threats and capitalize on opportunities.

Enhanced Stakeholder Trust: Good corporate governance practices build trust among stakeholders, including investors, customers, employees, and the community, enhancing the organization’s reputation and credibility.

Increased Access to Capital: Companies with strong corporate governance practices are often viewed more favorably by investors and lenders, making it easier to raise capital.

Long-Term Sustainability: Corporate governance focuses on long-term value creation, ensuring that companies consider the impact of their decisions on future performance and sustainability.

Better Decision-Making: Clear governance structures and processes enable more informed and effective decision-making, leading to improved business performance.

Legal and Regulatory Compliance: Corporate governance helps organizations comply with applicable laws, regulations, and standards, reducing the risk of legal issues and penalties.

Why AGMC

Coprehensive

Free Expert Assistance

Best Price Guarantee

4.9/5 Google Rating

Money Back Guarantee

Simple & Fast Process

Frequently Asked Questions (FAQs)

What is the role of the board of directors in corporate governance?

The board of directors is responsible for overseeing the company’s management and operations, setting strategic goals, and ensuring that the company complies with legal and regulatory requirements.

How does corporate governance differ between public and private companies?

While the principles of corporate governance are similar for public and private companies, public companies are subject to more stringent regulatory requirements and are accountable to a broader range of stakeholders, including shareholders.

How can companies improve their corporate governance practices?

Companies can improve their corporate governance practices by establishing clear governance structures, ensuring transparency and accountability, and regularly reviewing and updating their governance policies and procedures.

What are the consequences of poor corporate governance?

Poor corporate governance can lead to a range of negative consequences, including financial losses, reputational damage, legal issues, and regulatory sanctions. It can also erode stakeholder trust and confidence in the company.